Mega-regionals: What

Is Going on?

Introduction

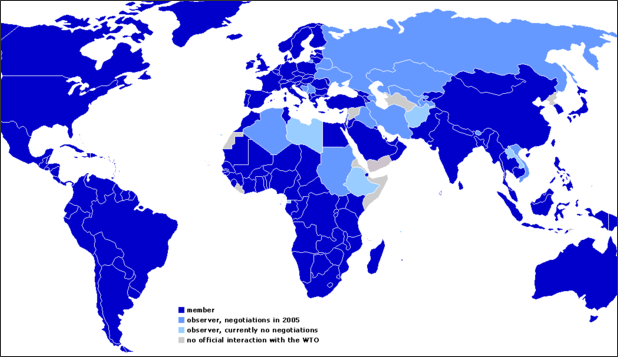

A lot is happening on the trade negotiations front in almost

every corner of the world. Countries have been active and

prolific at the bilateral and regional levels for some time – 432

RTAs have been notified to the WTO. But the key ongoing

negotiations are of a different dimension: they involve more

partners, from different levels of development and different

regions, covering larger volumes of trade, and aiming at

reaching agreements of a deeper nature on a wide scope

of issues. These are the mega-regionals, of which the

Trans-Pacific Partnership and the Trans-Atlantic Trade and

Investment Partnership are in a category of their own by virtue

of their scope and impact.

If current negotiations are successful, new rules will shape

trade and investment flows, underpin global governance on

21st century trade issues and facilitate the proliferation of

global value chains. Their purported emphasis on promoting

broad liberalization, reducing non-tariff barriers and addressing

regulatory hurdles through greater convergence would unleash

new opportunities and bring about more growth to the

world economy.

They may also contribute to bringing more

dynamism to the multilateral trading system, spearheading a

virtuous circle of enhanced rule making and trade liberalization.

Or they may not. Much will depend on the specific provisions

to be agreed upon and the type of preference they will create.

Not all preferences are equal.

Some of them carry a larger

potential for discrimination than others. The greater their

discriminatory nature, the higher the friction and fragmentation

risks they entail. On the contrary, provisions with low or no

discriminatory potential actually may be quite beneficial for

non-members.

This is no minor issue. While mega-regional negotiations

encompass a large number of countries, they exclude an

even larger group. About 160 nations, home to over 80% of

the world’s population, are sitting on the sidelines while these

discussions take place. The way in which countries choose to

react to these developments may determine, at least in part,

the impact of these pacts on individual non-members and

on different regions, as well as on countries that are party to

the mega-regionals. The broader question of the geopolitical

impact that mega-regionals may have in today’s world is an

issue that demands great reflection.

The multilateral trading system is not exempt from the impact

of mega-regionals. Much will depend on the specifics of the

agreements that are finally concluded, and in particular on whether they are crafted with an inclusive perspective and are

open to new members. Much will also depend on whether

WTO members opt to advance an ambitious post-Bali

multilateral agenda, which could include plurilateral agreements

as a way to proceed in consolidating the WTO’s centrality.

All of this presumes that mega-regionals will come to fruition

as planned, but this cannot be taken for granted. There are

big negotiating challenges ahead, and domestic political

divisions in participating countries to be bridged. If the megaregionals

fail, the consequences on the potential of trade and

investment to continue driving world growth and prosperity will

be considerable.

While there is a lot of uncertainty regarding the future and

impact of mega-regional agreements, it is clear that this is the

topic of choice in the global trade agenda today.

This is why

the World Economic Forum’s Global Agenda Council on Trade

& Foreign Direct Investment decided to dedicate its work this

year to Mega-regional Trade Agreements: Game-Changers or

Costly Distractions for the World Trading System?

Extensive discussions, with the participation of all Council

Members, showed that this is a rich subject that poses

important questions and ignites strong debates. A consensus

was not reached on all its angles, nor was that the main

purpose. Instead, the aim was to explore the impact that

mega-regionals may have on non-members, highlighting

opportunities and challenges in promoting the coexistence

of these agreements – should they materialize – with the

multilateral trading system.

With all the uncertainties and caveats surrounding the

negotiation of mega-regional agreements, there is a strong

case to be made on the importance of consciously working

to facilitate the relationship between them and the multilateral

trading system, for the benefit of all countries.

The Impact of Mega-regionals

For decades, but with particular impetus since the inception

of the World Trade Organization in 1995, many of the

WTO’s members have enthusiastically embarked in selective

associations with other members, aimed at more deeply

integrating their economies. These schemes vary in nature,

scope and effectiveness and range from free trade agreements

to custom unions to common markets.

The General Agreement on Tariffs and Trade (GATT) defines

free trade areas as those in which two or more custom

territories agree to eliminate duties and other restrictions

“on substantially all the trade” between them on products

originating in their territories.

Colloquially and in WTO practice

and law, such agreements are referred to as regional trade

agreements (RTAs) to differentiate them from unilateral

preferential schemes.

By the end of 2014, 432 RTAs had been

notified to the WTO, of which 238 were in force. In addition, countries have been prolific in establishing bilateral

investment treaties containing rules and commitments that

significantly affect trade in goods, services and technologies,

as well as other terms of further integration of national

economies into global markets. At last count, the world had

in place 3,196 international investment agreements (IIAs):

BITs and “other IIAs”.

Moreover, over 30 new RTAs, involving

more than 110 countries, are currently under negotiation,

with some of them geared to constitute a new order in

international economic governance given their design, content

and quantitative and qualitative weight in the global economy.

Significantly, they involve all the important poles of trade and

investment in the evolving global economy.

Several of these innovative agreements take place between

two or more countries in different regions, or between

countries with RTAs among them and individual countries or

groups of countries in other RTAs.

This type of composition is

not unprecedented, but the trend is now affecting more parties

and happens at a time when the Organisation for Economic

Co-operation and Development (OECD) estimates that

RTAs and IIAs already “cover among their member countries

90% and 60% of cross-border trade in goods and services,

respectively”.4

The last wave of agreements, in addition to

establishing lower applied tariff rates between parties (with the

collateral effect of generally lowering MFN applied rates), have

also added a universe of contractual commitments among

parties on provisions concerning mostly behind-the-border regulatory matters that go deeper than their WTO obligations

(WTO-plus) or that extend the coverage of WTO disciplines

(WTO-beyond or WTO-extra obligations).

The economic significance of RTAs has also been in

crescendo. RTAs of the past may have been defined more

by geopolitics, but the new trend is for a greater emphasis on

commercially meaningful associations that address several

emerging policy concerns. Also, new RTAs are organized

around a set of deeper integration issues that fosters

transnational collaborative production and global value chains.

They could be termed production-sharing RTAs or regulatory

integration RTAs given their emphasis on an increasingly

common and extensive package that in addition to market

access includes services, competition policy, investment

(including capital movement provisions), technical barriers and

regulatory compatibility, intellectual property protection and

customs cooperation. By their nature, at this time, trends in

integration reflect three types of dominant RTAs:

a. FTAs of substantive current or potential trade and FDI

value. Examples under negotiation or recently concluded

include US-South Korea; EU-Singapore; EU-Canada; EUJapan;

EU-India; EU-Mercosur; Australia-China; CanadaKorea;

Canada-India; the embryonic CJK; and BITs

between the US and China and the EU and China.

b. Consolidation RTAs, in which existing RTAs are expanded

through new membership or by merging with other

RTAs. An example of a recent effort is the novel Pacific

Alliance which practically fuses and further integrates six

pre-existing FTAs among Mexico, Colombia, Peru and

Chile, with possible extension to Costa Rica and Panama.

The emphasis is on tariffs, services and cumulation of

imports for rules of origin. Another example is the Tripartite

Free Trade Area in Africa, aimed at consolidating three

subregional agreements, i.e. the East African Community

(EAC), the Common Market for Eastern and Southern

Africa (COMESA) and the Southern Africa Development

Community (SADC).

c. Mega-regional RTAs, deep integration partnerships in the

form of RTAs between countries or regions with a major

share of world trade and FDI and in which two or more of

the parties are in a paramount driver position, or serve as

hubs, in global value chains (i.e. the US, the EU, Japan,

China). This category includes ongoing negotiations in the

TPP; the emerging TTIP between the EU and the US; and

potentially the RCEP, between the 10 ASEAN5

countries

and six of its RTA partners: China, India, Japan, South

Korea, Australia and New Zealand. Beyond market access,

emphasis in this integration is on the quest for regulatory

compatibility and a rules basket aimed at ironing out

differences in investment and business climates.

This report’s focus is on this last category, and on the TPP

and the TTIP in particular. They are singled out given their

conformity with criteria that profiles them as a potential new

pillar of trade governance6

, complementary to the multilateral

trade system:

a. The agreement would affect a share of at least a quarter

of world trade in goods and services (TPP: 26.3%; TTIP:

43.6%)7

and of global FDI.

b. At least two economies party to the agreement are hubs

in GVCs as evidenced by their share of trade intermediate

goods and tasks in the region or regions involved.8

c. The agreement’s coverage goes deeper and beyond

existing – 2013 – contractual obligations and disciplines of

the WTO, RTAs and BITs. In this context, the agreement

addresses a minimum of areas and regulatory reform

essential to 21st century world markets such as services,

investment, competition policy, regulatory convergence, the

digital economy and customs cooperation.

d. Parties to the agreement are engaged in multiple RTAs

with third-party economies and enjoy extensive trade

and investment exchange with a significant number of

non-members, making the partnership a potential reverse

trade-diversion scheme.

The Trans-Pacific

Partnership (TPP) and the

Trans-Atlantic Trade and

Investment Partnership

(TTIP) – Key Issues and

Potential Impact on

Members

TPP

The TPP encompasses a number of East Asian and North

and South American countries.

In 2006, Brunei, Chile, New

Zealand and Singapore initiated a four-way FTA, termed the

Pacific-4, with a vision of comprehensive trade liberalization

being implemented by 2015. By 2010, an additional five

countries, the United States, Australia, Malaysia, Peru and

Vietnam, signalled their intention to join the agreement,

leading to the creation of the TPP. Since then, Mexico,

Canada, Japan and South Korea have requested to join

the TPP, and during 2013, existing members approved

participation of the first three candidates in the expanded

TPP (often referred to as the TPP-12).11 By mid-March

2014, South Korea completed the first round of bilateral

consultations with each of the 12 parties. However, at this stage, no additional member would be expected to join before

an agreement is first finalized by the TPP-12.12

The TPP aims to achieve extensive liberalization of both

goods and services, and entails comprehensive coverage

of trade in services, investment, government procurement,

non-tariff measures and many regulatory topics, as indicated

in Box 1. However, as highlighted by the Congressional

Research Service, the 12 countries are economically and

demographically diverse. The US is more than twice as

large as any other TPP country in terms of its economy

and population; there is wide variation in levels of economic

development between member states, and each has

significantly different strategic and economic interests.

Box 1 – The Content of TPP

The following topics are reported to be included in the

ongoing TPP negotiations:

– Market access for agricultural and industrial products.

Parties aim for duty-free access for trade in goods.

They are also dealing with export and import licensing

procedures, customs issues and trade facilitation.

– Services. The agreement would employ a negative list

approach and cover financial services, including insurance

and insurance-related services, banking and related

services, as well as auxiliary services of a financial nature,

to be addressed in a separate chapter.

– Government procurement. Agreement states common

principles and procedures, as well as specific obligations

for conduct of procurement; it aims at comparable

coverage by all members, while recognizing transitional

measures for procurement markets of developing

countries.

– Agriculture, other than market access. It will deal with

sanitary and phytosanitary standards (SPS); tobacco

regulation; and agricultural competition.

– Rules. The TPP will include chapters and provisions

that build on disciplines contained in the WTO’s Uruguay

Round agreements on Technical Barriers to Trade (TBT)

and intellectual property rights (IPR) enforcement. For

example, the TPP TBT text introduces provisions that

would remove restrictions for testing, inspection and

certification services providers, such as in-country

presence requirements. On IP, it would agree to a shared

commitment to the Doha Declaration on TRIPs and Public

Health and include innovative provisions, particularly on

(i) Patents (e.g. available for plants and animals and for

diagnostic, therapeutic and surgical methods for the

treatment of humans and animals and adjustment of the

duration of patents to compensate for delays occur in

the granting process); (ii) Undisclosed data (e.g. exclusive

protection for five years of the pharmaceutical safety

and efficacy information, from the date of marketing

approval, in the territory of a party including similar

protection for safety and efficacy of a product previously

approved in another territory; further protection for at least

three years on new clinical information for the approval

of a pharmaceutical product containing a previously

approved chemical entity including those previously

approved in another territory); (iii) Copyright (e.g. term

Game-Changers or Costly Distractions for the World Trading System? 15

* Excludes USA and Japan

Source: Draper et al., P10-11.

Figure 1. Trade among TPP Member Countries ($ billion), 2012

200

0

700

1200

1700

2200

Trade among TPP Member Countries ($ billion), 2012

Intra-NAFTA trade NAFTA-Japan trade

TPP-NAFTA* TPP-Japan* Intra-TPP trade*

58%

12%

11%

10%

9%

of protection in the case of juridical persons of 90-120

years compared to the standard of 70 years in TRIPS;

improved legal remedies against the circumvention of

effective technological measures); and (iv) Enforcement

measures (e.g. expansion of existing standards in TRIPS,

ACTA and KORUS on civil and administrative procedures,

including provisional and border measures and criminal

procedures and penalties, namely, in cases of trademark

counterfeiting and copyright or related rights piracy and

misappropriation of trade secrets and a section on internet

service providers). TPP would also include provisions on

biologics and transparency and procedural fairness in

healthcare technologies.

– Rules of Origin: Cumulation of origin. Since many of the

parties to the TPP are trading partners in FTAs, being

part of the TPP implies that inputs originating from a TPP

country that are included in a final good exported by

another TPP nation to a third TPP member are regarded

as originating in such nation. This fosters the participation

of TPP members in regional production networks.

– Investment: Provisions of investment protection, ensuring

non-discrimination, a minimum standard of treatment,

rules on expropriation and prohibitions on specified trade

distortive performance requirements. Also, provisions for

investor-state dispute settlement subject to safeguards to

protect the rights of TPP countries to regulate in the public

interest.

– Competition Policies: Establishment and maintenance

of competition laws and authorities, procedural fairness

in competition law enforcement, transparency, consumer

protection, private rights of action and technical

cooperation.

– Trade Remedies

– Separate chapters on labour and environment. On

the latter, it may contain substantive provisions on new

issues, such as marine fisheries and other conservation

issues, biodiversity, invasive alien species, climate change,

and environmental goods and services, in addition to

cooperation for capacity building.

– Other new and cross-cutting issues will include regulatory

coherence; state-owned enterprises; e-commerce;

competitiveness and supply chains; and small and

medium-sized enterprises.

Given the significant economic diversity of member states in

terms of wealth, production structures and strategic goods,

the TPP’s wide coverage requires extensive negotiations

between member states in order to achieve the goal of a

significant and far-reaching agreement. In addition, the goods

sector is being negotiated based on the existence of current

bilateral FTAs. Thus, where FTAs exist between countries,

they are likely to be adopted within the TPP, while countries

without an existing FTA between them have entered into

negotiations on a bilateral basis.14 Meanwhile, other issues are

being negotiated among all participants; yet, the goal remains

a single agreement applicable to all members. This complexity

has some implications for the eventual outcome, and is

discussed further below.

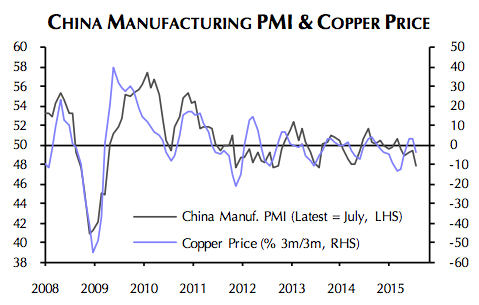

The TPP can significantly impact on global trade dynamics,

given that goods trade among TPP partners amounted

to more than $2 trillion in 2012 (see Figure 1). The North

American Free Trade Agreement (NAFTA) (Canada, Mexico

and the US) and Japan nevertheless accounts for the

largest proportion of this trade, with intra-NAFTA trade alone

amounting to nearly $1.2 trillion in 2012. Bilateral trade

between Japan and NAFTA accounted for close to $250

billion (over 80% of which was between the US and Japan)

of total intra-TPP trade, with Japanese exports to NAFTA

countries accounting for $160 billion.

Trade flows between the remaining TPP-12 members made

up only $180 billion of total TPP trade. Trade between the

remaining TPP-12 members and NAFTA, and between the

rest of the TPP-12 and Japan amounted to $233 billion and

$204 billion respectively.15 Clearly, the NAFTA countries,

particularly the US, and Japan are the key drivers of the

TPP. Indeed, the US and Japan, in line with what has been

suggested by Baldwin (2014) and with evidence generated by

estimating shares of trade in intermediate goods and services

for the US and Japan and partners in the TPP and other

economies in the Pacific basin, drive supply and transnational

organization of production and serve as regional hubs.16

The large number of FTAs being implemented between

Asian and Pacific states also suggests that the effects of tariff

liberalization may be low despite the significant share of global

trade accounted for in this region. Cheong (2013) underlines

the extent to which FTAs may dilute the effect of liberalization

on goods trade, with countries in the Asia-Pacific region

having signed close to 100 FTAs (either bilateral or regional)

between themselves. Cheong (2013) further notes that many

previous studies estimating the effects of regional FTAs in the

region may have therefore over-estimated the gross domestic product (GDP) and trade gains likely to be achieved through

greater regional integration in this region by not taking into

account that goods trade is already significantly liberalized

through the numerous FTAs already being implemented.17 In

terms of goods trade, the TPP faces a similar situation, with

many countries within the TPP already trading under free

trade arrangements.

Cheong (2013) suggests that the gains for member states

from goods trade liberalization through the TPP are likely to be

negligible for most member countries. All countries, with the

exception of the US, Chile and Peru, are likely to experience

a marginal increase in their GDP. However, for all members,

this increase is less than 1%, with New Zealand experiencing

the greatest gain (0.97%) and Canada the lowest (0.02%).

Conversely, the results suggest that the US is unlikely to

experience any change, while Chile and Peru are likely to

experience negligible GDP declines of 0.13% and 0.04%

respectively.18

Estimates from the Peterson Institute for International

Economics suggest the potential impact of the TPP may be

somewhat larger, when including the impact of reducing nontariff

measures.19 The model assumes a staggered approach

to the implementation of the TPP, with an agreement among

the nine original members by 2013 and the three additional

members (plus South Korea20) one year later. Enforcement

occurs one year after the agreement is signed, followed

by five years of implementation. The study finds that by

2025, real GDP will increase by 0.75% for TPP members.

The potential impact on individual countries ranges from

a positive 0.4% impact on GDP for the US to a 13.6%

improvement in GDP for Vietnam. Similarly, exports could

increase significantly, from 2.5% for Chile to 37% for Vietnam.

Vietnam’s gains are expected to arise through its expanded

role as a manufacturing centre of textile and garment

industries.

Cheong (2013) and Williams (2013) both note that many

see the TPP as a stepping stone to the creation of a free

trade agreement among all APEC members, given that

TPP members form a sub-set of APEC. As Williams (2013)

highlights, TPP country trade with the other APEC members

not currently party to the TPP negotiations is larger than

intra-TPP trade, amounting to over $2.7 trillion in 2012, with

China accounting for over 50% of this trade. The creation of

an APEC free trade area (also known as the Free Trade Area

of the Asia-Pacific) would be the largest single market on the

planet, bringing significant gains to member states. Petri and

Plummer (2012) estimate that these gains could amount to

an additional $2 trillion (2007 dollars) by 2025, or an increase

in APEC GDP by 3.5%. The long-term gains from the TPP

for member states may therefore be substantially greater if

this agreement creates a domino effect where all other APEC

members subsequently “fall” into the TPP.

TTIP

The TTIP negotiations, launched in June 2013, aim for a

far-reaching trade agreement between the US and the

EU, focusing on trade liberalization, behind-the-border

and other non-tariff barriers as well as seeking a “high

standards” approach to alignment, compatibility and possible

harmonization of regulations and standards governing the

goods, services, investment and public procurement markets,

as shown in Box 2

Box 2 – The Content of TTIP

TTIP negotiations are organized in three baskets, each

encompassing the following set of issues:

a. Market Access

– Removal of all duties in industrial and agricultural

products, with special treatment for the most sensitive

products

– Rules of origin

– Trade in services, which seeks liberalization in new

sectors, e.g. transport, excluding audio-visual services.

b. Regulations and Non-Tariff Barriers

Parties aim at regulation system compatibility and

alignment, to be achieved by a combination of

simplification and harmonization of procedures for

compliance and regulation-making, and the establishment

of a standing scheme for regulatory cooperation towards

the future. Such a scheme would built on the existing High

Level Regulatory Cooperation Forum (HLRCF) and involve

regulators, the regulated community, technical experts

and other stakeholders. An innovation will seek a common

framework approach on emerging technologies, namely,

e-mobility, nanotechnology and smart grid, and eventually

health IT and cybersecurity.

c. Rules

– Trade defence measures to establish a systematic

dialogue on anti-dumping and countervailing duties

– Investment, with guarantees of protection against

expropriation, free transfer of funds, fair and equitable

treatment and a level playing field for investing

companies, investment protection, including investorto-state

dispute settlement, relevant safeguards and

right to regulate

– Public procurement

– Financial regulation rules

– Intellectual property rights, including geographical

indications – reportedly aiming at further promoting

robust IP frameworks and effective levels of

enforcement with emphasis on the digital environment

and attempts to reconcile their respective regimes on

geographical indications and data flows

– Labour and the environment – innovation includes

illegal logging and illegal, unreported and unregulated

fishing (IUU).

In addition to the above, the agreement would include new

“21st century” issues, e.g. modernization and simplification

of trade-related aspects of customs and trade facilitation;

competition policy; state-owned enterprises; raw materials

and energy; small and medium-sized enterprises; forced

localization of production; and transparency.

MFN tariff regimes in the EU and the US are comparatively

low, as noted by Ecorys (2009), Rollo et al. (2013) and

Fontagne et al. (2013). Fontagne et al. (2013) estimate that

the average tariff protection on EU goods imported by the

US amounts to only 2.2%, while US goods imported by

the EU attract an average tariff duty of 3.3% in ad valorem

equivalent terms.22 It is clear that tariff liberalization, while

forming an important component of TTIP negotiations, is

unlikely to achieve significant economic gains for either the US or the EU, with the exception of the removal of duties on a

comparatively small number of sensitive products.

More significant gains are likely to be made through the

elimination of non-tariff measures and ex-ante and expost

compatibility and alignment of standards regulation

and systems that act as barriers to trade, investment and

public procurement. Many of the non-tariff impediments and

frictions cannot be completely removed (such as geographic,

cultural and language barriers) and both the US and the EU

recognize that there are legitimate philosophical, structural,

institutional and legal differences that have resulted in different

approaches to risk and regulation across the Atlantic.

Still, any progress on compatibility of regulation, through

harmonization or mutual recognition of technical standards,

facilitation of conformity assessments, pre-market or postmarket

oversight, or addressing market access impediments

to providers of testing, inspection and certification services,

can bring about significant reductions in the costs of trade

and investment in both markets and for third-party providers.

Compared to low tariff barriers, Ecorys (2009) and Fontagne

et al. (2013) estimate that bilateral ad valorem equivalent

protection between the US and the EU from non-tariff

measures was significantly higher and ranged between 19%

and 73% across the agriculture, manufacturing and service

sectors. Ecorys (2009) estimated that roughly 50% of nontariff

measures and regulatory differences between the US

and the EU could be eliminated.

The potential impact of the TTIP on the US and the EU

has been evaluated by a number of studies.

The earlier

Ecorys (2009) study suggests that the reduction of nontariff

measures would produce modest improvements in

national income and real wages for the US and the EU,

while changes to total exports could be more substantial. In

an “ambitious” scenario, where 50% of non-tariff measures

and regulatory divergence are eliminated, real income could

increase by 0.3% and 0.7% in the long run for the US and

the EU respectively. In a “limited” scenario (where 25% of

non-tariff measures and regulatory divergence is eliminated) real income in the long term could increase by 0.1% for the

US and by 0.3% for the EU. In the long term, total exports by

the US could increase by 6.1% and 2.7% in the ambitious

and limited scenarios, while EU exports could increase

by 2.1% and 0.9% respectively. More recently, a study

commissioned by the EU, effectively updating and using

a similar methodology to that of Ecorys (2009), produced

similarly modest results.23

Fontagne et al. (2013), using a different computable general

equilibrium modelling technique and an alternative estimation

of non-tariff measures, finds that a 25% reduction in non-tariff

measures coupled with a full reduction in tariff duties could

produce a 0.3% increase in the GDP of both the EU and

the US over the long run. The volume of total exports could

increase more significantly in the long run, by roughly 10%

for the US and by approximately 8% for extra-EU exports.24

In contrast to these studies, Felbermeyr et al. (2013) use for

the Bertelsmann Institute a gravitational econometric model

approach to estimate the size of protection from non-tariff

measures. They find that the implementation of the TTIP may

produce substantially larger economic gains.25 They find that

tariff liberalization could result in a real per capita income

increase of 0.27% for the EU (unweighted mean) and 0.8% for

the US. The impact is much larger under a deep liberalization

scenario, with the full reduction of non-tariff measures. Under

this scenario, real per capita income increases by 13% for

the US and 5% for the EU.

However, the vast difference

in estimated impacts between this study and those noted

previously (including the study commissioned by the EU)

has resulted in the EU suggesting that the Bertelsmann

Institute’s study is based on an untested methodology “that

departs from the standard approach used so far in other

similar studies” and that some of the results produced are

“unreasonable and inconsistent” and “unrealistically high”.

Regardless of one’s view on modelling techniques and

associated results, it is clear that a reduction of non-tariff

measures and regulatory differences will play a much more

significant role in unlocking economic gains for both the US

and the EU than a reduction in traditional tariff duties.